October Bankruptcy Filings Climb 12.2% Year-Over-Year, Hitting Highest Monthly Total in Over Five Years

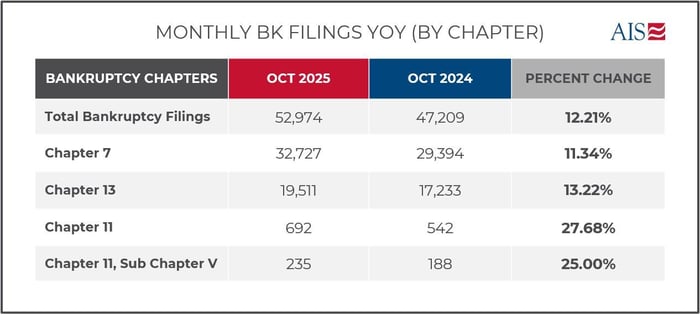

October closed with 52,974 total filings, up 7.7% from September’s 49,200 and 12.2% from October’s 2024 47,209. This marks the highest monthly total since 2020 and the largest October volume since 2019. Year-to-date, 2025 filings have reached 476,461, up 10.6% over the same period last year. While still roughly 20% below pre-COVID October averages, the last 12 months now total 555,080, confirming sustained momentum heading into the final quarter.

A Closer Look by Chapter

Chapter 7 filings rose to 32,727 in October, up 7.9% from September's 30,338 and 11.3% higher than October 2024's 29,394. Filings under Chapter 7 have continued to outpace those under Chapter 13, reflecting the financial strain among individuals with fewer non-exempt assets and limited repayment capacity.

Chapter 13 cases increased to 19,511, reflecting an 8.5% month-over-month gain from 17,986 and a 13.2% year-over-year rise from 17,233. The steady increase suggests that while more consumers are turning to bankruptcy, a larger share are doing so through structured repayment rather than liquidation.

Chapter 11 reorganizations totaled 692, a decline of 18.2% from September’s 846 but still 27.7% higher than October 2024’s 542. Subchapter V filings continued to trend upward with 235 in October, up 17.5% from September and 25% year-over-year.

Market and Economic Factors to Watch

The Federal Reserve’s second consecutive rate cut lowered the target range to 3.75 to 4.0 percent, offering limited short-term relief for distressed borrowers. Any impact on Chapter 11 activity will likely lag as higher costs and tighter credit conditions continue to pressure balance sheets.

In the subprime auto lending sector, recent Chapter 11 filings by PrimaLend Capital Partners have amplified concerns about rising borrower defaults that are now approaching 10 percent. Analysts cite high interest rates, depleted savings and persistent inflation as ongoing challenges for lower-income consumers and lenders.

Broader indicators point to modest growth, continued inflation, and fiscal strain, creating conditions that are keeping bankruptcy volumes elevated as the year comes to a close.

Looking for Further Insight?

For additional perspectives, watch the recording of our recent Q3 Bankruptcy Review Webinar, where our industry experts discussed key filing patterns, legislative updates, and market implications. Access the recording here.